Table of Content

An FHA Streamline Refinance is a great way for a borrower with an existing FHA backed mortgage to reduce their interest rate, reduce their payment or possibly both. These are the basic qualifications for an FHA loan through #COMPANY_NAME#, as you can see FHA loans can be to qualify for. To learn more contact us or apply online to get the process started. Lower Credit Borrowers Qualify – because FHA insured loans are backed by the government those with a poor credit history have an easier time getting this kind of loan.

Individuals need to provide their desired advance amount, applicable interest rate, and repayment term to the calculator, which displays the resultant EMI accordingly. The housing finance company was established in 1989 to financially assist individuals who wish to construct or purchase a residential property. Later, LIC Housing Finance Limited became a public company in 1994, promoted and controlled by the LIC of India.

Construction Loans

Can I club my income with that of family members to be eligible for a higher loan amount? Yes, Piramal allows you to club your income with that of your close family members, such as a spouse, parent, or child to get a higher loan amount. Ben, Meg, and the rest of the DHL team made the lending process the easiest transaction of my home buying experience!

These loans are popular with borrowers who don’t have enough funds to pay a traditional 20 percent down payment because they only require 3 percent down to qualify. Those who choose these loans are required to pay mortgage insurance which slightly increases their monthly payments. Lenders who wish to offer these loans must be approved by the Department of Housing and Urban Development. Please contact us today to find out if a FHA loan is right for you.

Home Equity Loans

When it comes to home mortgage loans, LIC Housing Finance Limited is considered one of the most prominent financiers in India. It is a subsidiary organization of the Life Insurance Corporation of India with its corporate office situated in Mumbai. An FHA 203 loan allows borrowers to finance both the purchase and renovation of a primary residence or to finance the renovation of their existing home. Basically, it allows borrowers to buy and refinance a home that needs work and roll the renovation costs into the mortgage. Piramal Capital & Housing Finance offers home loans with attractive interest rates that start at 10.50% p.a. Loans can be availed for up to 90% of the property cost for a maximum tenure of 30 years .

Purchase of a flat, row house, or bungalow from a private developer in an approved project with a home loan. There are certain limitations to properties that can qualify for FHA loans because they must meet standards such as basic health and safety. Our team has been closely monitoring and evaluating the situation around COVID-19. We are committed to trying to find appropriate ways to help support our customers and employees during this uncertain time. Give us a call today for a free, personalized consultation. We'll ensure you're the very first to know the moment rates change.

Your Loan Balance May Not Increase To Cover The New Loan Costs

Credit score verification is not required with an FHA Streamline Refinance – instead of checking your credit, your payment history is used to determine fi you qualify or not. You must have no late payments in the last 90 days and only one or less late payment within the last 12 months. If you already have an FHA mortgage then you might qualify for a FHA Streamline Refinance.

Even if you haven't found your dream house yet, Piramal Finance can help you get a pre-approved home loan. A pre-approved house loan is a loan that has been authorised in principle based on your income, creditworthiness, and financial situation. After using the calculator to estimate your EMI, you can quickly apply for a house loan online from the comfort of your own home using Piramal Finance's online home loans. Borrowers with excellent credit are more likely to get better rates from conventional loans.

Flexipay Home Loan Calculator

We are committed to quality customer service, putting the people we serve first. We strive to make you a client for life and we want to be your first choice each and every time you need a home loan. FHA insured mortgages are some of the best kinds of mortgages available. This is because they can help more people into the home buying market. Check out the list below to understand some of the most basic benefits of an FHA mortgage.

Our commitment to nation-building is complete & comprehensive. SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI. Construction loans for plots that are either freehold or leasehold, or plots that have been assigned by a Development Authority. Seller can contribute up to 6% in closing cost assistance to the buyer per FHA loan guidelines. These materials are not from HUD or FHA and were not approved by HUD or a government agency.

Individuals can also alter the values of tenure and loan amount component to find out the best loan option for them. There also exists a mini version of the FHA 203k called the Streamlined FHA 203k made specifically for lower borrowing amounts that are processed much more easily. Piramal home loan can be availed by both salaried as well as self-employed people as well. We were first time buyers and they were very communicative.

With as many benefits as they come with, there are reasons why they haven't been adopted as the universal method for mortgage loans. At DHL Mortgage, formerly known as Direct Home Loans, our mission is to set a high standard in the mortgage industry. We are committed to quality customer service - putting the people we serve first. After you select the loan that is best for you, we will work continuously on your behalf to help you achieve your dream of homeownership.

Piramal Finance also engaged in several financial services businesses. With the plethora of business loan benefits, many businesses tend to lean towards Piramal Finance for their financial needs. Expert legal and technical advice to assist you in making the best possible property purchase decision. Development Authorities such as the DDA, MHADA, and others offer home loans for the acquisition of properties.

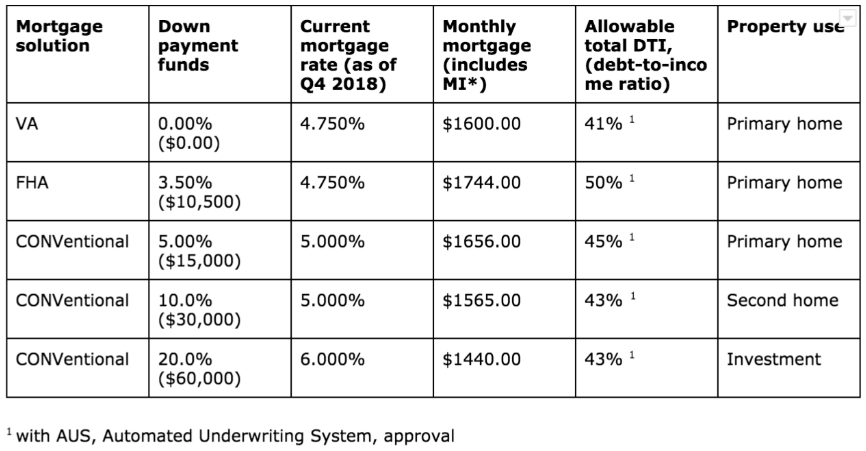

The maxgain calculator allows you to calculate the savings in comparison to regular home loan. Home Loan Balance Transfer calculator allows you to calculate benefit of transferring your home loan from any bank to SBI. Nandini is a working woman who has obtained a housing loan of Rs. 35 lakh at a 7% per annum interest rate for 15 years. Proof of substantial savings, usually three months' worth of mortgage payments in the bank. It becomes immediately apparent that FHA loans have the most stringent debt-to-income ratio requirements. After all, the FHA was essentially created to absorb the risk inherent in handing out many loans that could be defaulted at any time.

No comments:

Post a Comment